Happy Tuesday!

A slightly longer form essay today. Hope you enjoy

-NLW

At least when it was crypto markets going bonkers it made sense.

The bubble of 2017 had a lot of things going for it. Tokenization had created an entirely new mechanism that let people trade effortlessly. There was hype in the air and the promise of an entirely new technology movement.

When it comes to the stock market right now, it could give the crypto markets in 2017 a run for their money.

Since March 23, the markets have seen their largest 50 day gain in history.

In fact, not a single stock is down in 10 weeks.

Companies with no product and no revenue have higher market caps than Ford.

The shift in a matter of days has been remarkable.

And, as a Bloomberg piece put it "Everywhere You Look Under Surging Stocks Is Fervid Retail Buying”

Let’s start this with another headline - this time from CNBC: “Robinhood traders cash in on the market comeback that billionaire investors missed”

Robinhood is a stock buying app. It has 10 million users, 3 million of whom signed up during Q1 of this year. The average age of its users is 31.

To get a sense of the mindset of its users, here’s a quote from the above mentioned CNBC article:

“I just started taking it seriously about two months ago,” Godbolt — a New York resident— told CNBC. “I’ve been watching AAL since the beginning of that time and I felt eventually, once Covid relaxed, markets would move up.”

This generation of investors isn’t just embodied in Robinhood.

Before COVID-19 hit, a Bloomberg Businessweek cover story focused on the growing community on Reddit r/wallstreetbets - which was 900,000 members at the time and has surged to 1.3m.

Some have also called this the “Davey Day Trader Effect” after Barstool Sports founder Dave Portnoy, who began day trading to kill time and make money during the shutdowns. Dave’s part of the story - his embodiment of this cohort - brings us to our next point.

There are a confluence of factors that combined to make this happen when it did:

Extra time - many people out of work, no sports or hobbies to kill time with

Extra money - there is good evidence that stimulus money went right into the markets (instead of into for example deferred mortgages)

Cheap infrastructure - free trading has become the norm over the last year

The strategy has been two part.

The first part is that they’ve simply (shocker!) made common sense bets. Pharma companies trying to address COVID specifically. Kids education companies (hello, home school!). Companies dealing with compliance in a post COVID-19 world.

The second part is that they’ve made a fundamentally different bet than some very storied investors about how long lasting the human behavior impacts of COVID-19 would be. While Buffett sold all his airline stocks, and others were cashing out of cruiselines and casinos, they were betting that people wouldn’t change their behaviors nearly as much and pumped those stocks to the moon.

The third part is the craziest, and the part we’ll get to in just a minute.

First, we need to discuss the relationship between this new cohort and the professionals.

Famed investor Stanley Druckenmiller said this week that he was “humbled” by the equities markets. In the wake of his very public decision to drop his airline positions, Buffett has now been proven very publicly wrong.

Dave Portnoy made light of that in a clip from his most recent Davey Day Trader Global.

Amazingly, this got picked up by MarketWatch.

Holding aside the entire master’s thesis I could write on Portnoy and modern media, the resounding thing here is this: the Robinhood crowd does not care about professional investors.

It does not care what CNBC, Bloomberg, or any other financial MSM think.

It only cares about what its group of peers think.

And most of all, it only cares about the game.

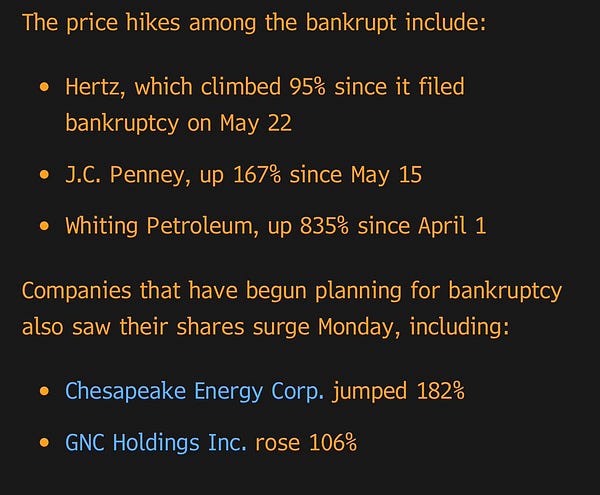

This is, of course, best expressed in the Robinhood Revolutions strangest bet of all: bankrupt companies.

Could there be any more pure expression of capitalist market nihilism.

In a world where everything is about asset prices and number go up; where the Fed will do whatever it takes with their unlimited cash to ensure that no company can fail, why wouldn’t you take this all the way? Why wouldn’t you take greater fool theory all the way to its ultimate conclusion? Why wouldn’t you pump a zombie company more than 100% in a day?

There is a facade that we are a consumption-based economy.

We’re not anymore.

We’re an asset price economy. It doesn’t matter that the majority of people don’t own stocks, or that basing so much of our monetary policy on ensuring continued growth in assets rewards the already rich and punishes the poor and savers. This is simply the way of the world.

The Robinhood Revolution is both a pure and a cynical response to the game the Fed and our financial institutions have set up.

If the game is rigged, play it better than the pros.

After all, as Portnoy said, an asteroid could hit the earth and number would still go up.

I see four possible scenarios:

1) The party continues and it crowds out space for crypto - in other words, if you can watch $10k in Hertz turn into $125k a few weeks later, who needs shitcoins?

2) Good for “crypto” - in this scenario, which involves stocks continuing up, at some point people start looking for other sources of alpha and move beyond markets to the altcoin casino.

3) Good for Bitcoin (specifically) - This is the scenario in which the party continues, but rather than just looking to diversify and find alpha, people are getting actively nervous about how absurd the traditional markets are getting and looking for something uncorrelated

4) Mixed for Bitcoin - This is the scenario where the stock party ends. The way it shakes out could be good or bad. The bad would come if people who have exposure to bitcoin get wiped out and need to sell off. The good would be that, depending on what type of crash or correction we see, there would perhaps be a push for more uncorrelated assets and alternative narratives that could benefit bitcoin.